Everything about Mileagewise - Reconstructing Mileage Logs

Everything about Mileagewise - Reconstructing Mileage Logs

Blog Article

Our Mileagewise - Reconstructing Mileage Logs PDFs

Table of ContentsNot known Facts About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs - The FactsEverything about Mileagewise - Reconstructing Mileage LogsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsSome Of Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsUnknown Facts About Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range function recommends the shortest driving route to your staff members' destination. This function improves performance and contributes to set you back financial savings, making it a crucial property for services with a mobile workforce. Timeero's Suggested Path attribute better increases responsibility and performance. Staff members can compare the recommended route with the actual path taken.Such a method to reporting and conformity simplifies the typically intricate task of handling mileage costs. There are lots of benefits linked with utilizing Timeero to keep track of gas mileage.

Mileagewise - Reconstructing Mileage Logs for Beginners

With these devices in operation, there will certainly be no under-the-radar detours to increase your compensation costs. Timestamps can be discovered on each mileage access, enhancing credibility. These added confirmation measures will maintain the IRS from having a factor to object your mileage records. With accurate mileage tracking modern technology, your employees don't need to make rough gas mileage estimates or also worry regarding gas mileage expenditure tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all cars and truck expenditures (mileage tracker). You will certainly need to proceed tracking mileage for job even if you're utilizing the real cost approach. Keeping gas mileage records is the only way to different organization and personal miles and supply the proof to the IRS

Many mileage trackers let you log your trips manually while calculating the distance and reimbursement amounts for you. Lots of likewise come with real-time journey monitoring - you require to begin the application at the beginning of your journey and stop it when you reach your final location. These applications log your beginning and end addresses, and time stamps, together with the complete range and compensation quantity.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

This includes prices such as fuel, upkeep, insurance policy, and the lorry's depreciation. For these expenses to be thought about insurance deductible, the lorry needs to be used for business purposes.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

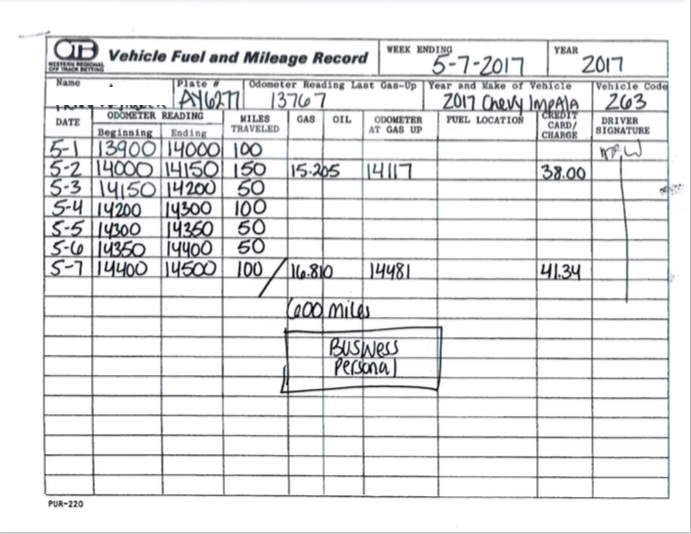

Begin by taping your auto's odometer reading on January 1st and after that once again at the end of the year. In between, vigilantly track all your service trips taking down the starting and finishing analyses. For each trip, record the location and company objective. This can be simplified by keeping a driving visit your vehicle.

This includes the overall business mileage and complete mileage buildup for the year (business + personal), journey's day, location, and objective. It's necessary to record activities without delay and preserve a coexisting driving log describing date, miles driven, and organization objective. Right here's how you can improve record-keeping for audit objectives: Start with making sure a thorough gas mileage log for all business-related traveling.

Not known Details About Mileagewise - Reconstructing Mileage Logs

The real expenses approach is an alternative to the basic gas mileage rate method. Rather of computing your deduction based on a predetermined rate per mile, the real expenditures approach permits you to subtract the actual prices related to utilizing your vehicle for service purposes - mileage log for taxes. These expenses consist of gas, upkeep, repair services, insurance, depreciation, and other associated expenses

Those with considerable vehicle-related expenses or unique problems might profit from the actual costs technique. Please note choosing S-corp status can transform this computation. Eventually, your chosen approach needs to straighten with your details financial objectives and tax obligation scenario. The Standard Gas Mileage Rate is a measure released annually by the IRS to establish the deductible prices of operating an auto for service.

The 4-Minute Rule for Mileagewise - Reconstructing Mileage Logs

(https://www.4shared.com/u/0-U_xJ8E/tessfagan90.html)Whenever you use your car for company journeys, videotape the miles traveled. At the end of the year, once again write the odometer analysis. Determine your complete company miles by utilizing your start and end odometer readings, and your taped organization miles. Precisely tracking your specific mileage for service journeys aids in substantiating your tax obligation reduction, specifically if you go with the Requirement Gas mileage method.

Keeping track of your mileage by hand read this article can require persistance, however keep in mind, it might save you money on your taxes. Adhere to these steps: Jot down the day of each drive. Tape the complete gas mileage driven. Think about noting your odometer analyses prior to and after each journey. Write down the beginning and finishing factors for your trip.

Facts About Mileagewise - Reconstructing Mileage Logs Revealed

In the 1980s, the airline sector came to be the initial commercial users of general practitioner. By the 2000s, the shipping industry had actually embraced GPS to track packages. And now almost everyone makes use of general practitioners to obtain about. That means virtually every person can be tracked as they set about their business. And there's the rub.

Report this page